Litecoin at $883 each?

6/28/14: Over on my bitcoin price prediction page, I wrote about Max Keiser’s prediction that the crypto-universe could grow by 100x. Right now, CoinMarketCap says the entire cryptocurrency market is worth about $8.3 billion. Multiply that by 100, and you’ve got a market that’s worth $830 billion. Litecoin makes up about 3.3 percent of the entire cryptocurrency market. If the overall market grew to $830 billion, Litecoin could be worth 3.3 percent of that ($27.4 billion or $883 each assuming there are 31 million litecoin in existence at that point). I’d love to see that day, but I suspect litecoin’s share of the market could decline as competitors continue to go online and bitcoin strengthens its position as the industry leader. Keiser seems to agree: “Let me be clear,” he says. “Everybody should have, as their core holding, some bitcoin. Bitcoin is here to stay and is set to top $400 billion. I agree with the Winklevoss twins on this.” Still, that’s a lot of money to spread around all the various altcoins.

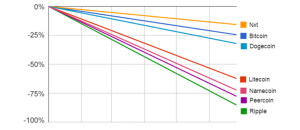

Litecoin performance YTD

6/28/14: Yesterday, I published a chart showing the year-to-date performance of the Top 10 cryptocurrencies by market cap (duplicated below). Litecoin hasn’t been doing great. It’s down more than 62 percent since the beginning of the year. That puts it in the middle of the pack. Namecoin, peercoin, bitshares-pts, ripple and mastercoin have fared worse. Bitcoin on the other hand has lost just 24 percent of its value. The big winners are darkcoin (up 3,600%) and blackcoin (up more than 1,070%). As scrypt mining grows in sophistication, I suspect miners are swapping their litecoin for bitcoin and privay-centric coins like darkcoin, boolberry and monero. Let’s hope litecoin can keep growing so it doesn’t fade into obscurity. Check out my original post here.

Litecoin has out-performed bitcoin over the past six months

5/10/14: Over the past six months, litecoin is up 490 percent, per Valuewalk. That’s 3.5 times higher than bitcoin’s 140 percent gain over the same time period.

It’s hard to say why litecoin hasn’t fallen further, but I suspect it has to do with governmental actions against bitcoin in China. When the price of BTC spiked to $1,2000, much of that demand was driven by Chinese investors. Since then, the People’s Republic has taken a string of increasingly hostile stances toward the currency.

Litecoin on the other hand is still relatively new in China. In fact, it wasn’t until March of this year that China’s biggest bitcoin exchange announced that it would start offering litecoin trading (per Coindesk). In any event, litecoin’s relative strength compared to bitcoin is great news for investors.

Litecoin price prediction basics

While litecoin isn’t as rare as bitcoin, it’s still extraordinarily rare for a currency. There will only ever be 84 million litecoin created (vs. bitcoin’s 21 million). At the time of this writing, 28 million litecoin have been created and 12.7 million bitcoin have been created.

To put those tiny numbers in perspective, consider the fact that the the Bureau of Engraving and Printing printed 26 million U.S. bills (in various denominations) with a face value of approximately $1.3 billion in fiscal year 2013 (source). That doesn’t take into account electronically-created dollars and existing bills.

There are two primary factors driving the value of litecoin (and any altcoin):

- Usefulness

- Investment/Speculation

Litecoin has proven itself useful in limited areas. The coin’s unique in that it has garnered widespread adoption as a currency trading pair on currency exchanges. That means you can trade litecoin for bbqcoin, mintcoin or flappycoin without bitcoin being involved in the transaction at all.

However, litecoin lags bitcoin significantly when it comes to merchant adoption. Any future where litecoin is valuable must involve a significant volume of litecoin transactions. Not to worry, though. I suspect a PayPal-like payment processor that handles numerous altcoins will soon be available. That will make it easier for e-commerce sites to accept litecoin, ripple and other alternative cryptocurrencies. Indeed, I wouldn’t be surprised to see a company like Coinbase or Bitpay start processing litecoin transactions in the near future.

My litecoin price prediction

Part of litecoin’s appeal is the fact that it’s cheaper and easier to acquire than bitcoin. That means that if the price rises too high, it’ll lose some of its luster. I’m not sure what that price ceiling is. Currently, one litecoin is worth about 2.5 percent of the value of one bitcoin. In December, when bitcoin spiked north of $1,110, litecoin surged to $43. That was about 4 percent of the value of one bitcoin at that time.

Ultimately, my litecoin price prediction rests on the expectation that litecoin will consistently trade at a measurable fraction to the price of bitcoin: probably somewhere between 2 percent and 5 percent. So, the higher the price of bitcoin goes, the higher the price of litecoin goes. My personal price target in the near-term for bitcoin is around $10,000 (learn why here). If that ever happened, we could see litecoin prices around $200 (2 percent of the price of BTC) to $500 (5 percent of the price of BTC).

Want more? Check out my Bitcoin price prediction (BTC) page, my Ripple price prediction page and sign up for our newsletter below!

Background photo credit: Livadakiva

Can't miss cryptocurrency news!

- Bitcoin’s ‘Wall Street Phase’ just around the corner

- Ripple Labs to sue Kraken CEO?

- Analyzing Jed McCaleb’s departure and the ripple currency plunge (XRP)

- Altcoin ETF could radically alter cryptocurrency space

- Bitcoin price prediction (BTC)

- Ripple and Fidor just changed cryptocurrency forever

- In 5–10 years, a ripple address will be as normal as email'

- 10 professional bitcoin price predictions

- Ripple price prediction (XRP)

- Satoshi Nakamoto quotes

- The 218 most popular cryptocurrencies by social media presence

- How I became a Bitshares believer

- Litecoin price prediction (LTC)

Ethan

Thanks for posting this 😉

Interesting points and prediction. I wonder if at some point in the future, if litecoin can gain significantly more acceptance and continue to be useful, if that rato of ltc/btc value will increase to or anywhere near the fabled 1/4th or 25% against the bitcoin.. simply based on the fact that they basically serve the same function but there are 4 times as many total litecoins.

Since the other distinction is the faster block/confirmation times I suppose it could be even more valuable than that.. but the first runner status and overall support of bitcoin is so strong that it’s hard to see ltc gaining that much traction for many years if ever unless something unfortunate happens to btc.. or confirmation times suddenly become a game changer in the future.

So many possibilities! The crypto/digital-finance space is so new and potentially game changing that it’s really interesting to speculate and watch how things play out.